Protecting Your Livelihood:

Why Every SMB Needs General Liability, E&O, and Cyber Insurance, and How To Qualify!

Download a Free PDF of this article to share with your leadership team

Download a Free Business Insurance Preparation Checklist to get the best rates possible.

Small to Medium Businesses (SMB) face a myriad of risks that can jeopardize their financial stability and reputation. One critical strategy to mitigate these risks is obtaining commercial general liability (CGL) insurance, errors and omissions (E&O) insurance, and cyber liability insurance. And though there is always the option of being ‘self-insured’, most businesses cannot afford this. This article explores the importance of liability insurance, the key players in the process, the benefits it brings, and how to ensure you pass the underwriting!

Understanding CGL, E&O, and Cyber Insurance

- Commercial General Liability (CGL) Insurance: Covers businesses from claims of bodily injury, property damage, and other liabilities from operations. Essential for any business to handle physical risks.

- Errors and Omissions (E&O) Insurance: Also called professional liability insurance, it protects against claims of negligence, errors, and omissions in providing professional services. Crucial for firms offering professional advice.

- Cyber Liability Insurance: Protects against data breaches and cyber incidents, covering notification costs, legal fees, and recovery. Critical for businesses with digital operations given today's cyber threat landscape.

Depending on your industry and risk appetite, your company may be best protected by obtaining one, two, or all three of these insurances!

Why is Liability Insurance a Must Have?

- Financial Protection and Risk Mitigation:

Over the years I’ve witnessed several client-brought lawsuits that occupied a tremendous amount of valuable company time, resources, and money to respond and defend. Liability insurance provides a financial safety net for businesses. It covers legal fees, settlements, and judgments, which could otherwise cripple a business financially. For example, if a consultant makes an error that results in financial loss for a client, the ensuing lawsuit could be financially devastating without proper insurance coverage.

- Compliance with Client and Legal Requirements:

In responding to and completing numerous client questionnaires, most that I’ve encountered required proof of liability insurance. This makes HAVING insurance a necessity for winning the business, let alone complying with legal agreements and avoiding legal penalties.

- Enhancing Business Credibility and Trust:

Clients want to KNOW you are reputable and secure. One of the ways this confidence is built is by presenting that you have liability insurance. It shows that the business is prepared to handle potential risks and is committed to providing professional and reliable services. This can be a significant differentiator in a competitive market.

The Section of Doom and Gloom

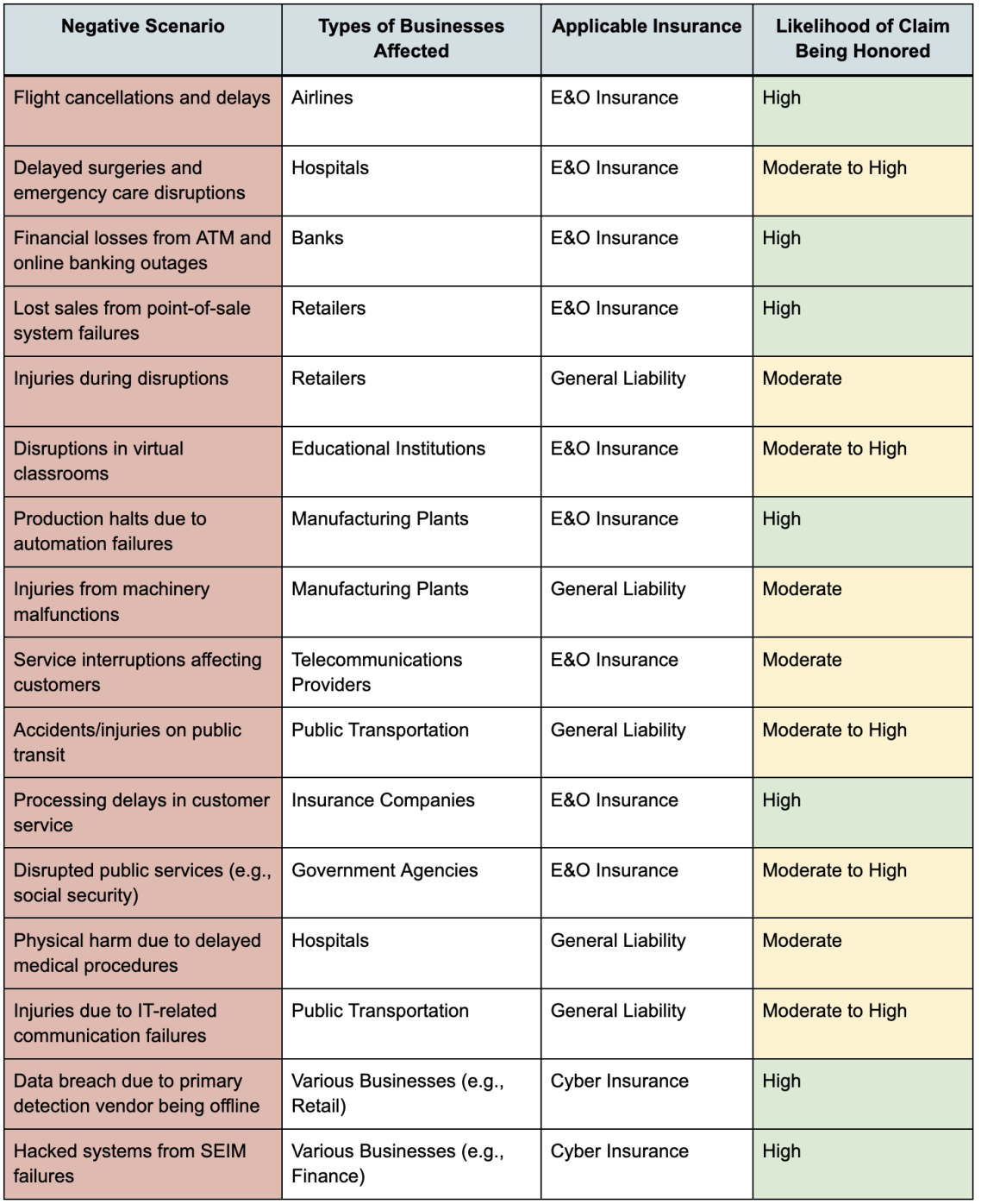

OK, look, it’s hard to get any interest in appreciating risk if you don’t already have a taste of it. In light of the recent global IT outage, companies affected may be able to file claims if they have the correct insurance in place.

Here are a few examples:

Place yourself in the shoes of these business owners…

- Healthcare Technology Company

You're an innovative healthcare technology company that develops cutting-edge electronic health record (EHR) software for clinics. One day, a critical malfunction in your system leads to the irretrievable loss of patient data, causing significant treatment delays and potentially severe health consequences. The incident draws the ire of healthcare providers and patients alike, leading to regulatory investigations and a barrage of lawsuits. The combined financial strain and reputational damage threaten the very survival of your company. Professional liability insurance (errors and omissions insurance) would cover the malfunction in EHR software.

- Retail Business

You operate a bustling retail store, and a sophisticated cyberattack targets your online payment system, resulting in the theft of thousands of customers' credit card details. This breach leads to a significant financial downturn as loyal customers lose trust, cease shopping at your store, and voice their grievances on social media. The negative publicity not only tarnishes your brand reputation but also invites legal scrutiny and potential lawsuits from affected customers. Cyber liability insurance would cover the financial losses due to the cyberattack.

- Construction Company

As the owner of a thriving construction company, you rely heavily on advanced project management software to streamline operations. However, a targeted cyberattack breaches your system, exposing sensitive client data and proprietary project details. The breach causes delays and loss of client trust, leading to substantial financial penalties. Additionally, affected clients demand compensation and threaten legal action. The fallout not only strains your finances but also jeopardizes future business opportunities. Professional liability insurance (errors and omissions insurance) could cover breaches in project management software.

- Event Venue Company

You manage a large event venue hosting concerts, conferences, and gatherings. During a sold-out concert, a section of the ceiling collapses, injuring several attendees. The incident draws negative media attention and results in lawsuits from the injured parties, seeking compensation for medical expenses and damages. Event organizers also demand compensation for the disruption. General liability insurance covers the legal costs, settlements, and medical expenses, providing financial support to handle the lawsuits and manage the fallout, ensuring the business can recover and continue operations.

Cost-Effectiveness and Long-Term Savings

No doubt when you reviewed the scenarios mentioned above, something probably came to mind about your own business and inherent risks that may require further protection. While the cost of liability insurance is an additional expense, it is a worthwhile investment compared to the potentially devastating costs of a liability claim. The premiums paid for insurance can save businesses from significant out-of-pocket expenses and ensure long-term financial stability.

Who Are the Key Players in the Insurance Industry?

- Policyholders: That's you! You pay premiums to cover your butt in case something bad happens.

- Insurance Companies: They take your premiums and invest them. They love customers who rarely file claims because it means more money stays in their pockets.

- Brokers: Intermediaries who facilitate the purchase of insurance policies by helping policyholders find suitable coverage and negotiate terms with insurers. These folks get commissions or fees for helping you find the right insurance and negotiating the terms.

- Regulators: Government watchdogs ensuring everyone plays fair - ensuring compliance with laws and regulations.

- Reinsurance Companies: Insurers that provide insurance to other insurance companies, helping them manage risk by spreading it across multiple entities, and making money from premiums and investments.

How Do You Get Started with Liability Insurance

- Evaluate Your Insurance Needs: Assess the specific risks associated with your operations and determine the level of coverage needed. This is no simple task, requiring an examination of your current policies, procedures, and practices, and usually with the help of a risk assessment professional.

- Select Appropriate Coverage: Work with a knowledgeable broker to find suitable insurance policies that meet your needs.

- Navigate the Underwriting Process: Understand the underwriting criteria and work with underwriters to secure the best terms and pricing.

What’s Required to be Underwritten?

Proof! Proof that you are a low-risk investment for the insurance company. To provide this proof you’ll need to produce quite a few documents as part of the application process. Things like…

- Information Systems Policies and Procedures

- Business Continuity Plan, Disaster Recovery Plan, Incident Response Plan

- List of all major Software Applications, and Third Party Vendors

- Model Customer SLA Agreement, and Customer Contract

- Defined Roles of Responsibilities and Who Fills These Roles (i.e. designated privacy officer)

- Computer Systems Controls: Asset and Data Inventories, Data Centers and LAN sites, Employee Training Records, Computer Systems Access Protections, Security Operations, and quite a bit more.

Will I Be Audited By the Insurance Company?

Perhaps! Insurers conduct audits to verify that the insured is adhering to the agreed-upon risk management practices and policies, which in turn helps in accurately assessing and managing the risk. You could be subjected to an ‘underwriting audit’, which is typically conducted under the following conditions:

- Policy Inception: At the start of a new policy, an initial audit may be conducted to establish a baseline and ensure that all necessary policies and procedures are in place.

- Policy Renewal: When renewing an insurance policy, underwriters may conduct an audit to ensure that the insured has maintained compliance with the policy requirements.

- High-Risk Activities: If the insured is engaged in high-risk activities or industries, underwriters may conduct more frequent audits to monitor compliance and risk management practices.

- Claims Activity: If there have been significant or frequent claims, an audit may be initiated to understand the causes and ensure that appropriate measures are in place to mitigate future risks.

- Significant Changes: If there have been significant changes in the business operations, structure, or risk profile, an audit may be performed to reassess the coverage and compliance.

- Random Selection: Some audits are conducted on a random basis as part of the insurer's overall risk management strategy.

And What if I Have a Claim, Will It Be Paid?

It ‘should’ be as long as your company has been following all of the documentation you provided up-front in the application process. For example, from an insurance perspective, if you are not in compliance with your Information Systems (IS) policies and procedures, several consequences can arise:

- Claim Denial: They might deny your claim if non-compliance caused the incident.

- Increased Costs: Higher premiums, coverage limitations, and deductibles.

- Policy Cancellation or Non-Renewal: Persistent non-compliance or significant incidents can lead to this. And since insurance providers share common databases, reinsurance may not be possible.

- Reputation Damage: Makes it harder to get favorable terms and increases the likelihood of audits.

Staying compliant with IS policies and procedures is key. Regular internal audits, employee training, and policy updates help maintain compliance and reduce these risks.

It’s a Package!

I've filled out loads of these applications, and it’s a hassle, especially if you're starting from scratch with policies and procedures. But here's the upside: going through this process makes your company stronger and more secure. Getting the right insurance coverage means you’re better protected against cybercrime and financial disasters. Without insurance, legal fees, settlements, and damages could be crippling. Liability, cyber, intellectual property, and product liability insurance all help manage financial fallout and protect your business. It all starts with a thorough analysis of your current state—the good, the bad, and the ugly.

Ever wondered how liability insurance can save your business from financial disaster? From flight cancellations to data breaches, discover how General Liability, Errors & Omissions, and Cyber Insurance protect against unexpected risks.

Learn why every SMB needs these coverages, the role of each insurance type, and real-world scenarios showing their importance. Essential tips for securing the right insurance and maintaining compliance to keep your business safe and thriving!

Download a Free PDF of this article to share with your leadership team

Download a Free Business Insurance Preparation Checklist to get the best rates possible.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.